The FleetPro Blog: Depreciation

We explain what it means for fleet managers

Managing Depreciation

The Depreciation Conundrum

18 August 2020

Confused by the options for managing depreciation?

We explain how depreciation can be controlled.

One of the biggest finance priorities fleet managers face is managing risk and, given that the biggest risk in fleet finance is depreciation, we thought we'd explain just which finance products can limit depreciation, minimise your risk and help control costs.

What Is Depreciation?

Dictionary definition of 'depreciation': noun meaning - the process of losing value

You probably already knew that, but it's worth reiterating for two reasons:

- It's a process

- It's all about loss

What the definition doesn't include is the word 'inevitable' which, unless your fleet is stocked with attractive classic vehicles, is probably just as applicable to the word 'depreciation'.

But despite depreciation being inevitable, it isn't a lost cause for fleet managers. Managing depreciation just requires a process to handle the loss.

The process is risk management - taking the most appropriate route to fix your depreciation risk without losing the benefit from any upside on residual values (if it should happen).

Risk Management

Risk and your business's tolerance of it, or aversion to it, is at the heart of any vehicle funding decision.

Risk, in essence, comes down to how much you think you know about the second-hand market for vehicles.

Put in other words, do you want to take the risk on potential losses from vehicle resale values when cars or vans come to the end of their working lives in your business?

If you buy outright, that's what you already do - the risk from residual value movements is yours.

Taken in the extreme though, can your business stand the financial impact of an unexpected drop in vehicle resale prices (known as 'residual values') when the time comes to sell?

'Ah yes', you might say, 'But what about the potential profits?''

'What if I can beat the second-hand market and sell above typical residual values?'

Well, just keep in mind that even residual value specialists in finance and leasing companies get it wrong from time to time, and some of those who got it wrong are no longer in business.

Look at it another way.

With some very rare exceptions, you loose money on cars and vans used in your business; this fundamental principle is recognised the world over.

Business accountants even have a word for managing depreciation in company books: 'amortization': noun meaning - the process of gradually writing off the initial cost of an asset.

Think about depreciation as a process which can be managed and you're taking the first step towards controlling depreciation.

Managing Depreciation

Despite its inevitability, you can manage your residual value risk and your exposure to depreciation.

Funding products exist that fix depreciation and avoid uncertainty, though these products come at a price.

Someone else, the finance company, will charge you money for the privilege of you being able to lay off your potential exposure to adverse fluctuations in residual values.

In effect, they charge you to allow you to use them to 'fix' your risk at a known amount.

The method by which the finance companies do this is a little complex, but stay with us and we'll explain how.

In vehicle finance products with a fixed risk, such as contract hire and contract purchase, the finance company puts a residual value forecast into the calculation of the monthly finance repayments, so all you repay is their forecast of depreciation during the contracted life of the vehicle (and not the whole of the purchase price of the vehicle as in, say, hire purchase).

However, the residual value they use in the finance contract will be less than the finance company's real expectation of the vehicle's residual value at the end of the finance agreement.

This difference between the 'real' value and the finance contract's residual value is known as the 'spread'.

The spread will vary between finance companies according to factors such as the mix of vehicles on their fleet and their appetite for risk, but for the sake of explanation here, let's say it is between 5-10% of the finance company's real expectation of vehicle residual values.

On this basis, the residual values built into fixed-risk finance products might end up being only 90-95% of how much the finance company really thinks a given vehicle will be worth at the end of a finance agreement (e.g. 100% of the true expectation, less the spread of 5-10%).

The Cost Of Risk Management

Now, charging you an extra 5-10% in depreciation increases the monthly payments you pay, but probably not so much that you would notice it on a fleet of one or two cars.

Think of it as an insurance premium that you pay to the finance company inside your monthly finance rentals for them to take on the risk of a drop in the vehicle's residual value.

Now, let's assume the residual value actually ends up at 100% of the value the finance company really expected.

The finance company will then make a 5-10% profit on the sale of the vehicle.

It built into the finance repayments an expectation of a residual value lower than the value actually achieved and then pocketed the difference in value when the vehicle was sold.

However, the finance company could get the residual value wrong by using a forecast value higher than that achieved when the vehicle is sold.

In that case they lose and you win, because your monthly finance payments capped the depreciation and you have no exposure to the loss incurred by the finance company.

You fixed your risk at the finance company's forecast residual value and they took the hit when the forecast residual value didn't materialise on the sale of the vehicle.

But there's a reverse side to this principle.

If the finance company wins because residual values on disposal of the vehicle were higher than their 100% value forecast, it means you lost.

And you lost not just once, but twice.

The finance company first made money on your vehicle at the end of the finance contract (instead of you) and you still paid them a 5-10% 'insurance' premium to take the risk.

It's a double-bubble pay-day for the finance company.

So, there's an upside and a downside to fixing your risk on vehicle residual values.

But what does this mean in reality for your fleet?

Horses For Courses

For the moment, think of it as:

'How much are you prepared to pay someone else to limit your exposure to vehicle depreciation without always losing the bet? '.

For one vehicle or a small fleet, the price of fixing your residual value risk may not be a major issue relative to the peace-of-mind it brings.

If that's the case then a fixed depreciation finance product such as contract hire may suit your company as its preferred fleet finance method.

With contract hire you know your deprecaition risk has been tamed and you will never face an unexpected loss (assuming you return vehicles in a condition matching their age and mileage).

However, if you have hundreds of cars or vans then the price of fixing your potential losses from a major drop in residual values could, in itself, have a significant impact on annual business profits.

If that's the case then a residual tolerant finance product such as contract purchase may be better.

In contract purchase you are given a minimum guaranteed future value for a vehicle based on its age and a forecast of its mileage at the end of the finance contract.

As long as the vehicle is returned to the finance company at the end of the agreement in a condition suitable for its age and mileage, the guaranteed minimum value will be paid for the vehicle and that completes your contract.

And it doesn't matter if residual values have dropped by the end of the contract - you're still guaranteed the minimum future value.

But if residual values have risen and your vehicle is worth more than the guarantee then you can exercise an option to purchase the vehicle for the guaranteed price and then sell or trade it in for the higher market value.

In this way your risk was fixed with the guaranteed minimum value, but you made a 'profit' by selling at the market value, and you did that without ever risking exposure to a drop in the value of used cars/vans.

Here Comes The VATMan

There is one slight complication with contract purchase.

Following a recent European Court ruling on VAT (and the UK is still subject to this ruling), in a contract purchase agreement the minimum guaranteed residual value you are given must be lower than the 'real' expected future value of the vehicle.

The difference must also be sufficient that you are more likely than not to complete the contract, purchase the vehicle and sell it at your 'profit'.

Why?

Well, if the residual value was the same as that used in contract hire then you are unlikely to ever exercise your purchase option at the end of the finance agreement.

And that means the true nature of the deal wasn't really a contract purchase agreement but a lease, or contract hire.

But contract hire/lease rentals are subject to VAT, whereas contract purchase payments aren't.

But by using the same residual as contract hire your contract purchase deal has taken on the look and feel of a contract hire deal and is therefore liable to VAT, which would be catastrophic for contract purchase as a product.

So to keep on the right side of the VATman, contract purchase minimum guaranteed values are deliberately lower than the real expected value of the vehicle at the end of the contract.

Win-Win Time?

Because of the VAT rules, if you take the contract purchase route and your guaranteed future value is always less than the 'real' expected residual value then, in theory, you should end up with a 'profit' on every vehicle at the end of the contract.

And in the event that residual values have in fact dropped further than expected, you simply hand back the vehicle to the finance company to complete the agreement and walk away leaving the finance company to take the loss, but only when a drop in values happens, not when the market rises.

And there's one further by-product of the VAT ruling which helps your business too.

The more of the capital (purchase price) you repay on a finance agreement, the faster your interest charges drop over the life of the deal.

So by making payments each month towards a forecast guaranteed value which is lower than 'real' market expectations, you are accelerating your capital payments and reducing the total interest charges for the deal.

Let's Not Forget ...

We've concentrated on risk management in this post, but of course there are some basic houskeeping duties you can perform to manage depreciation too:

- Get vehicles serviced and repaired on time

- Keep service records up to date, especially the service log book

- Consider annual or periodic valeting to identify interior and exterior damage

- Attend to bodywork damage before corrosion sets in

- Carry out pre-disposal inspections of vehicles in time to get repairs arranged

Turning Theory to Reality

So which way to go? Outright purchase, leasing, contract hire or contract purchase?

Well, measurement is the way you capture and tame your depreciation risk and determine which finance method would be better for your fleet.

But there's good news and bad news on the measurement front.

The bad news is that measurement of the difference between buying, leasing/contract hire and contract purchase is complex - these approaches have different implications for company taxes (both for profits and VAT), plus they have different cash-flow profiles too.

As a result, modelling isn't just knocking up a quick spreadsheet with some vehicle prices, residual forecasts and contract hire/contract purchase rental comparisons.

The good news is that there are tools available to do the hard work in measurement for you. These tools will:

- calculate your risk, including the tax, VAT and cash flow impact;

- compare your risk from buying to the cost of fixing that risk; and

- show you the difference in costs, both actual and cash-flow terms.

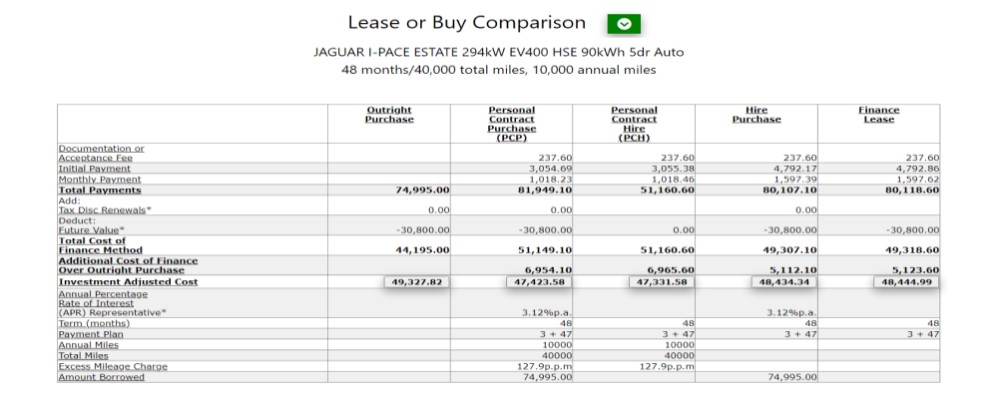

Click on the following link to use our free lease or buy calculator, a comprehensive measurement tool for evaluating your fleet finance options

Related Tools

Related Posts

What Else Do We Do?

FleetPro has a unique suite of free online tools to help you find the right car.

Take a look at some of our amazing calculators and decision tools for new car buyers.

-

Lease or Buy?

Could you lease a new car for less than the cost of buying? Our lease calculator will work out the best finance method for you. -

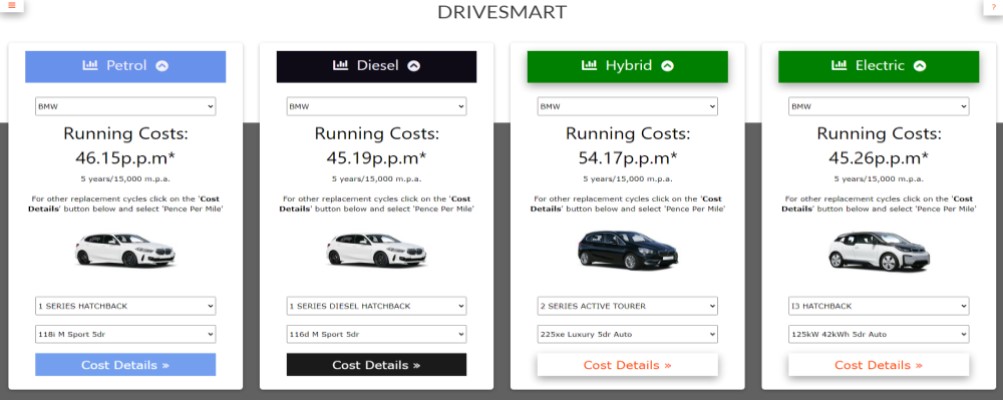

ICE or Electric?

Would an electric car be cheaper than petrol or diesel? Our ICE or electric calculator compares running costs instantly. -

Cash or Car?

Could you give up your company car for a cash allowance? Our 'cash or car' calculator will tell you. -

Car Search

Find your next new car by monthly payment, standard equipment, performance, economy and more .... -

fleetpro.co.uk

Why not visit our fleetpro.co.uk website and see for yourself the amazing range of tools and analysis? We'll keep your place here while you browse.