The FleetPro Blog: What Is Contract Purchase?

We explain how Contract Purchase works

What Is Contract Purchase?

What Is Contract Purchase?

14 July 2020

Buy now, reject it later

We explain how Business Contract Purchase works

Contract Purchase is a type of hire purchase that lets you buy a car or van, but change your mind later.

Don't worry if that sounds too far-fetched, that's really how contract purchase works.

It's perfectly legal and is used by thousands of fleet operators every year as a way to finance cars and vans.

How Contract Purchase works

In a normal asset finance agreement you repay the total cost of the item (a car, van etc) in monthly instalments over the life of the finance agreement

In a contract purchase agreement you only pay for part of the cost of the vehicle - payment of the rest of the money is postponed until the end of the agreement, when you can change your mind and just hand the car/van back to the dealer or finance company.

The part that you repay is the forecast depreciation (or drop in value of the vehicle) between the purchase date and the end of the agreement.

For example, let's say:

- your fleet is buying a car (and we'll talk about cars for the rest of this page, but contract purchase applies to vans too)

- the car costs £30,000

- it is expected to be worth £10,000 at the end of the contract purchase agreement.

Because the monthly payments only repay part of the purchase price of the vehicle this also makes them lower than ordinary finance repayments.

Too Good To Be True?

Well, yes, in one respect.

Because you are only repaying a smaller proportion of what you borrowed (the whole £30,000 purchase price of the car), more of the purchase price is left outstanding during the period of the loan.

As a result you are still charged interest on the amount outstanding each month, so the total interest payable under a contract purchase agreement will be higher than under a more traditional car finance agreement like hire purchase, even if the interest rate is the same.

Check The Small Print

You also need to check the small print in a contract purchase agreement as there are two types.

One type ('conditional sale') keeps ownership of the car with the finance company or dealer that supplied the car through until the end of the agreement.

You only get ownership if you complete the contract purchase agreement by paying the final 'balloon' payment at the end of the deal; if instead you simply hand back the car at the end it's as if you never had it in the first place.

The alternative type of agreement transfers ownership of the car to you at the outset (rather than at the end) of the finance agreement so you are the legal owner throughout the deal.

If your employees are buying cars with a cash allowance from your company and you set up the car deal for the employees (for example, with a preferred supplier) your employees can't use a conditional sale type of contract purchase agreement.

This is due to quirks in employment tax law which deem the car to be a company car, even though the employee enters into the finance agreement, not your business.

Watch Out For VAT

Following a ruling by the European Courts (which still applies to the UK), the final payment in a contract purchase agreement has to be set well below the expected market value of the car at the end of the finance term.

This means that you have to repay a bigger proportion of the car's price (in otherwords, undervalue the car at the end of the agreement) to avoid the taxman charging VAT on the monthly finance payments.

Your dealer/finance company should take care of this in the calculation of the final 'balloon' payment.

How Does Contract Purchase Work?

Normally the supplier of the car will arrange the contract purchase agreement for you.

Usually a deposit will be required (typically 10% of the purchase price or a fixed number of finance payments paid in advance, e.g. 3 or 6 months payments).

You then pay monthly payments for depreciation and interest charges until the end of the contract purchase agreement.

At the end of the agreement you will typically have 3 options. You can:

- hand back the car to the finance company (subject to return conditions - see below); or

- pay an optional final payment (sometimes called the 'settlement payment') and keep the car; or

- if the car is worth more than the final payment, make the final payment and sell the car, either keeping the 'profit' or using it as a deposit towards a replacement car.

If you do choose to hand back the car instead of paying the optional final payment then the car will normally be subject to a mileage and condition check. This is to make sure that the car has not travelled more than the agreed total mileage allowed in the finance contract and that the car's physical condition is in keeping with its age and mileage.

If the car has exceeded the permitted mileage then you will normally have to pay an 'excess mileage charge', usually a pence per mile figure which will be stipulated on the finance agreement.

In addition, if there is damage or wear and tear on the car in excess of what would be normal for a car of the same age and condition you will be charged for putting this right.

You finance company should inform you before you enter the finance agreement about what is and is not acceptable damage/wear and tear and some subscribe to the code of practice of the British Vehicle Leasing & Rental Association .

Advantages of Contract Purchase

Because the car's expected future value at the end of the finance agreement is fixed in the agreement, you know how much depreciation will be and how much you will get for your car when you have finished the finance repayments.

If the value of the car at the end of the agreement is more than the forecast residual value you can sell the car for the actual value and either keep the difference or use it as a deposit towards a new car.

Because the residual value is fixed you avoid the risk of the residual value being less than expected, so you are protected from unexpected drops in second hand car values.

Disadvantages of Contract Purchase

If you exceed the agreed contract mileage you will normally incur an excess mileage charge.

Interest charges will be higher than in a more traditional finance arrangement like hire purchase as you're not repaying the full value of the car.

The balloon payment at the end of the contract purchase agreement must be set below the expected actual value to avoid VAT problems, so you are repaying more depreciation than you need to.

Unlike Contract Hire you will normally have to make your own arrangements to pay for the annual tax disc renewal (unless you have also arranged a maintenance contract which includes this service).

Should You Lease Or Buy?

You can see the cost of buying a car on contract purchase compared to leasing it through Contract Hire using our lease comparison tool.

Related Tools

Related Posts

What Else Do We Do?

FleetPro has a unique suite of free online tools to help you find the right car.

Take a look at some of our amazing calculators and decision tools for new car buyers.

-

Lease or Buy?

Could you lease a new car for less than the cost of buying? Our lease calculator will work out the best finance method for you. -

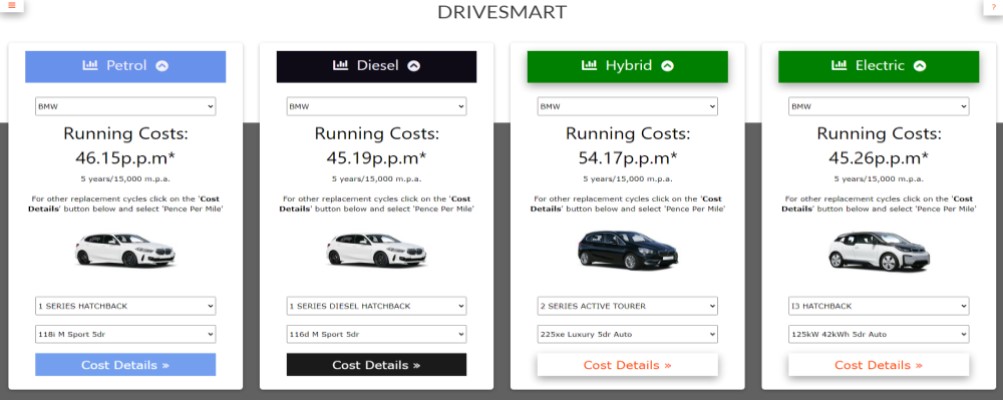

ICE or Electric?

Would an electric car be cheaper than petrol or diesel? Our ICE or electric calculator compares running costs instantly. -

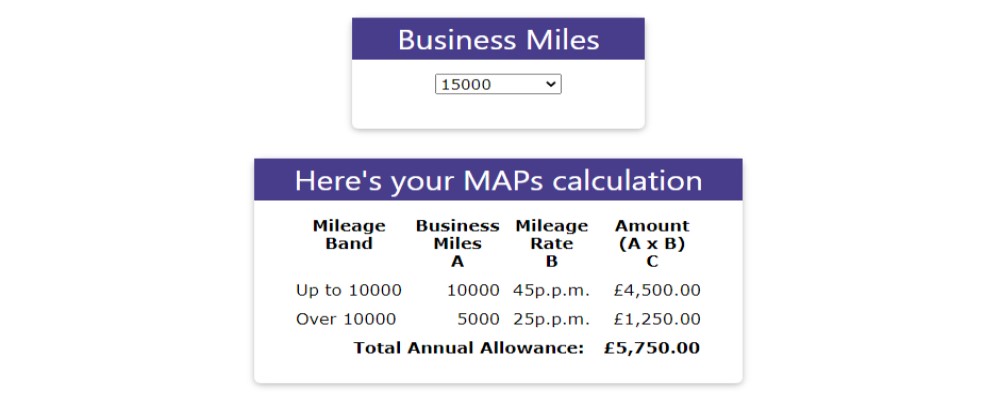

Cash or Car?

Could you give up your company car for a cash allowance? Our 'cash or car' calculator will tell you. -

Car Search

Find your next new car by monthly payment, standard equipment, performance, economy and more .... -

fleetpro.co.uk

Why not visit our fleetpro.co.uk website and see for yourself the amazing range of tools and analysis? We'll keep your place here while you browse.