The FleetPro Blog: What Is Contract Hire?

We explain how Contract Hire works

What Is Contract Hire?

What Is Contract Hire?

7 July 2020

Borrow it, hand it back!

We explain how Contract Hire works

Contract Hire is a way to borrow a vehicle for a long time then give it back.

Sounds perfect, but there are catches, so let's take a look at just what's involved and how to avoid the pitfalls.

How Contract Hire Works

In a contract hire agreement you lease a car (or a van, but we 'car' for simplicity) over a fixed period (or 'term'), usually a number of months or years during which the vehicle is still owned by the leasing company (the 'lessor') but is rented to you (the 'lessee').

In essence, you borrow the car from the lessor for a fixed period in return for a monthly lease payment (or 'rental').

What Do You Pay For?

During the lease term you pay a monthly rental to cover costs incurred by the leasing company to operate the vehicle, plus a profit too.

Basically you pay for:

- Depreciation in the value of the car over the life of the lease

- Vehicle Excise Duty - otherwise known as the 'tax disc'

- Interest on the money borrowed by the leasing company to buy the vehicle

- The leasing company's profit margin (which might be just the interest charges)

- VAT on the monthly rentals

At the end of the lease you just return the car to the leasing company which then sells the car and takes any profit or loss on the sale.

You only pay for depreciation during the lease term, so as each monthly rental is paid the payment reduces the outstanding amount financed by the leasing company at a much slower rate than in a traditional hire purchase agreement.

And because less of the purchase price is repaid each month, the total interest charged in a contract hire lease is more than in a hire purchase deal.

However, repaying a lower amount of the purchase price each month means that the actual monthly payments are lower in contract hire than for a hire purchase agreement.

Advantages of Contract Hire

Because the leasing company recovers VAT on the purchase price of the vehicle the monthly rentals are lower than comparable finance instalments for Contract Purchase, though VAT is then added to the monthly payment.

Because the vehicle is leased, the normal responsibilities of ownership, such as sourcing the best deal and obtaining the best resale (or 'residual') value, are avoided, as is the risk of the residual value being less than expected.

In effect, you simply operate the car rather than owning it, so contract hire is sometimes referred to as an 'operating lease'.

Disadvantages of Contract Hire

Although the leasing company can recover the VAT on the purchase price of the car or van, it also charges VAT on the monthly lease rentals.

For cars, the maximum amount of VAT on the lease rentals that your business can recover is 50% so, for example, if you paid £100 in VAT on a lease rental you can only claim back £50.

Click here to read more about this topic.

Similarly, the tax relief on lease rentals is restricted for cars with higher CO2 outputs - have a look at our explanation of tax relief for more details.

If the lease agreement is terminated earlier than expected then you may be required to pay an early termination penalty (usually a number of months' rentals).

In addition, if the vehicle is returned with more mileage than that agreed for the term of the lease, or is not in a condition appropriate for it's age and the lease mileage, then 'end of contract' charges may be made by the leasing company.

Should You Lease Or Buy?

You can see the cost of leasing a car on contract hire compared to buying it through Contract Purchase using our lease comparison tool.

Related Tools

Related Posts

What Else Do We Do?

FleetPro has a unique suite of free online tools to help you find the right car.

Take a look at some of our amazing calculators and decision tools for new car buyers.

-

Lease or Buy?

Could you lease a new car for less than the cost of buying? Our lease calculator will work out the best finance method for you. -

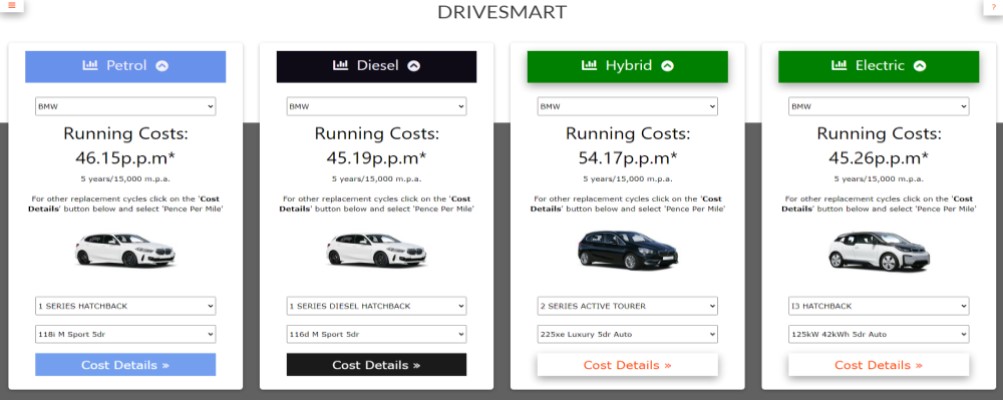

ICE or Electric?

Would an electric car be cheaper than petrol or diesel? Our ICE or electric calculator compares running costs instantly. -

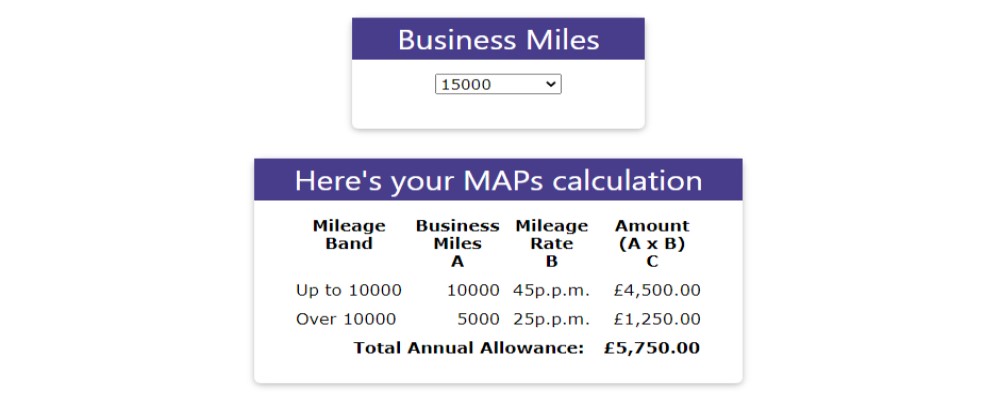

Cash or Car?

Could you give up your company car for a cash allowance? Our 'cash or car' calculator will tell you. -

Car Search

Find your next new car by monthly payment, standard equipment, performance, economy and more .... -

fleetpro.co.uk

Why not visit our fleetpro.co.uk website and see for yourself the amazing range of tools and analysis? We'll keep your place here while you browse.